We assist to get tax code for non-residents.

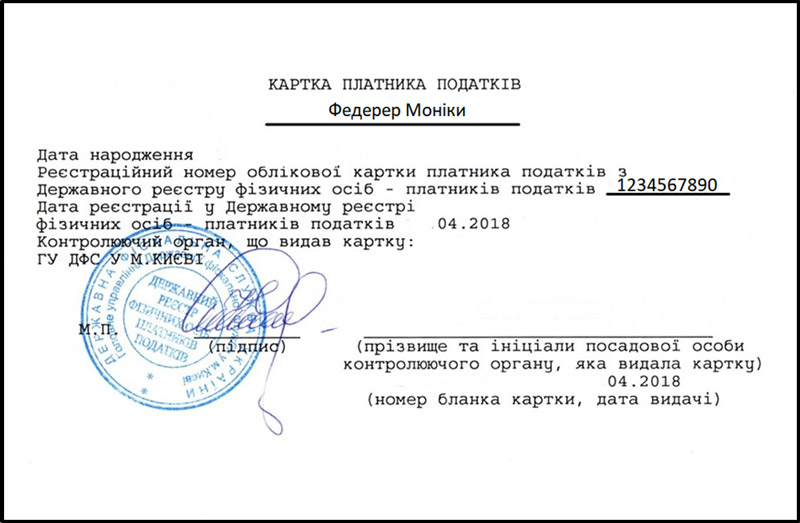

Tax code – it is an individual ten-digit unique code of the tax platform in the State Register of Individuals, which is a personal number for the payment of taxes and other mandatory taxpayers issued to non-residents of Ukraine, regardless of age.

Foreign citizens shall apply for tax code to Tax Authority of Kyiv, Sevastopol or relevant regional (oblast) Tax authority.

The tax code of a foreign citizen and a citizen of Ukraine are exactly the same.

A foreigner needs a tax code to:

- Signing notarized contract, issuing power of attorneys.

- Setting up a company in Ukraine.

- Employment.

- Submitting tax returns in Ukraine and paying taxes.

The term for issuing an identification code or duplicate, re-issuance or making changes to the card is 5 working days.

You can visit tax inspection personally or make a power of attorney to our lawyer, and he will do it for you.

We would need the following information/documents from the client:

| Documents/information | Client | Laudis Law Firm |

|---|---|---|

| Passport | + | |

| Translation of a passport into Ukrainian with notarization | + | |

| Application form | + | |

| Сopy of the page with information about the last entry into Ukraine | + | |

| Information of the permanent leaving address abroad | + |

The cost of this service is 50$ + 1200 UAH (the cost of the notary)